Bank of America warns: Trump's high tariff plan may exacerbate inflation, and the Fed may not cut interest rates this year

U.S. President-elect Trump is about to take office on the 20th. The Bank of America warned on Wednesday that the high tariffs that Trump may implement may cause the Federal Reserve to adopt a wait-and-see approach to cutting interest rates out of concern about a resurgence of inflation. The Federal Reserve may have completed the last rate cut of this round last month.

(Preliminary summary: Bitcoin fell by $96,000, Huida fell 6% and crashed U.S. stocks. The Federal Reserve may only cut interest rates once this year?)

(Background supplement: Federal Reserve Board members: The Fed will be more cautious in cutting interest rates, and U.S. stock valuations are prone to sharp corrections)

Aditya Bhave, U.S. economist at Bank of America In a report sent to clients on Wednesday, it was pointed out that there are currently more and more signs of stubborn inflation, and considering that the new Trump administration is about to take office, the Federal Reserve may have completed the last interest rate cut of this round:

Even without considering fiscal stimulus or tariffs, inflation is already a concern. These policy changes may pose upside risks to the Fed's core personal consumption expenditures (PCE) forecast (our forecast is 2.8% at the end of 2025), so the Fed may not cut further if the new administration announces large-scale tariffs soon after taking office.

Tariffs are taxes levied by the government on imported goods. Although U.S. consumers are not directly responsible for the tariffs, economists warn that some of the costs will be passed on to consumers in the form of higher commodity prices, which could push up inflation at least in the short term.

According to the summary of economic forecasts for individual policymakers released by the Fed last month, officials expected two more interest rate cuts in 2025, but Fed Chairman Jerome Powell said at the time that only some members took into account the potential impact of Trump's policies when making their forecasts.

Trump raised tariffs during his first term as president and has promised to further expand them in his second term. It has recently been reported that Trump is considering declaring a national emergency as a reason to implement comprehensive tariffs, but the actual scope of the tariffs is still uncertain, and some high-profile Trump supporters have also expressed opposition to the plan for comprehensive tariffs.

The market estimates only one interest rate cut this year

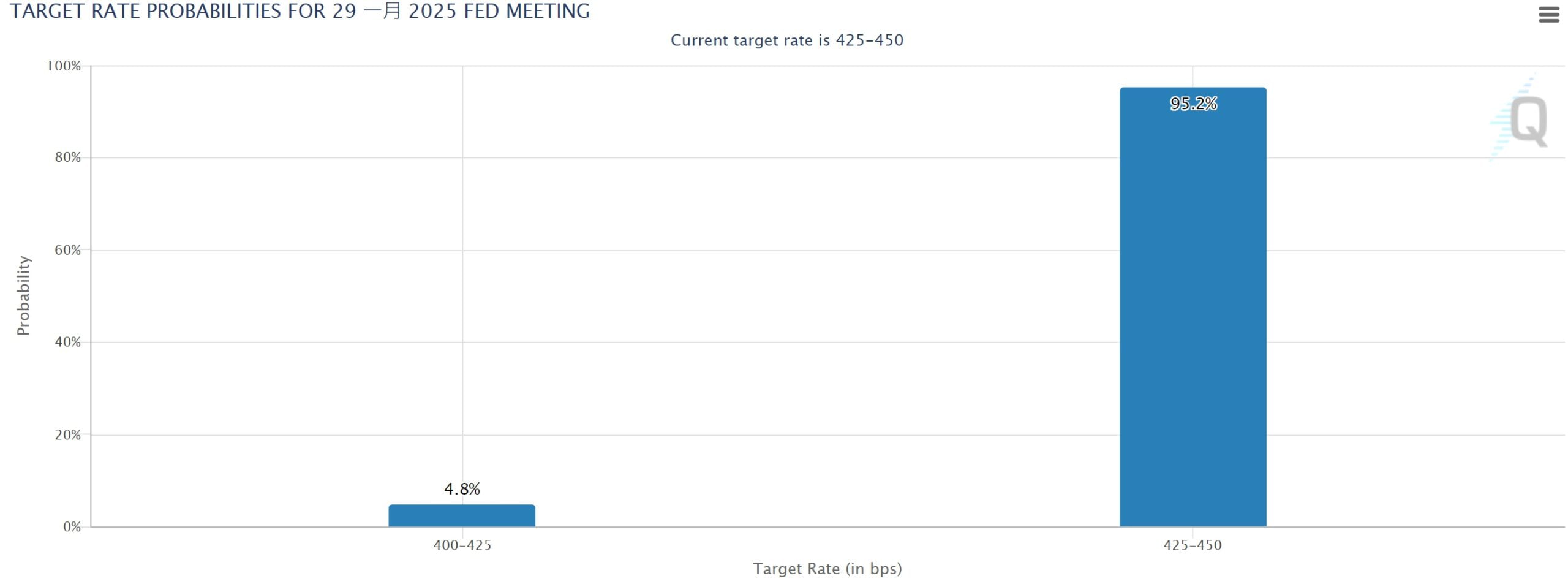

Amid tariff-related uncertainties, recent inflation data have been flat, but are still above the Federal Reserve's 2% target. Investors' expectations for further interest rate cuts by the Federal Reserve in 2025 are weakening. The Federal Reserve's benchmark overnight lending rate is currently between 4.25% and 4.50%.

CME’s FedWatch tool shows that the probability of the Fed keeping interest rates unchanged in January is 95.2%, and the probability of cutting interest rates by 1% is only 4.8%. The market currently predicts that the Fed will only cut interest rates once more by the end of December this year.

U.S. Treasury yields have also been rising steadily in recent weeks, another sign that traders expect interest rates to remain at high levels for longer. The current 10-year U.S. Treasury yields are reported 4.68%, much higher than the 4.178% at the end of November last year.

U.S. Treasury yields have also been rising steadily in recent weeks, another sign that traders expect interest rates to remain at high levels for longer. The current 10-year U.S. Treasury yields are reported 4.68%, much higher than the 4.178% at the end of November last year.