MicroStrategy added $740 million in Bitcoin positions, with total holdings approaching 610,000 BTC. MSTR has increased by 50% this year

Michael Saylor, the founder of MicroStrategy, announced on the

(Preliminary summary: MicroStrategy spent US$470 million to increase its position in 4,225 Bitcoins, making a profit of 30 billion magnesium! The market value of MSTR exceeded 120 billion)

(Background supplement: Is MicroStrategy going to sell Bitcoin? CryptoQuant Warning: New accounting and taxation force Strategy to pay taxes)

Contents of this article

MicroStrategy (now renamed Strategy), the dominant Bitcoin holdings among listed companies in the United States, once again used actions to prove its belief in Bitcoin. MicroStrategy founder Michael Saylor announced on July 21 through the

Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 $BTC acquired for ~$43.61 billion at ~$71,756 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/8z5HygrDWs

— Michael Saylor (@saylor) July 21, 2025

Details of the US$740 million position increase: source of funds and operating rhythm

According to the documents submitted by MicroStrategy to the SEC, most of the funds for this round of currency purchases came from the issuance proceeds of its common stock MSTR and preferred stocks STRK, STRF, and STRD. Different from the large-scale debt issuance in the early days, Strategy reduced the single debt risk through the "42/42 Plan" and switched to the equity financing route to ensure that the cash in hand can be converted into Bitcoin positions at any time.

Saylor has previously said that Bitcoin’s scarcity and fixed issuance are the core reasons for micro-strategy’s long-term bets; in his view, this investment is not just asset allocation, but insurance against inflation.

Holdings reached 607,770: floating profit exceeded US$28 billion

With the completion of the latest transaction, the number of Bitcoins held by Strategy has accumulated to 607,770, with a total purchase cost of approximately US$43.61 billion and an average purchase cost of US$71,756.

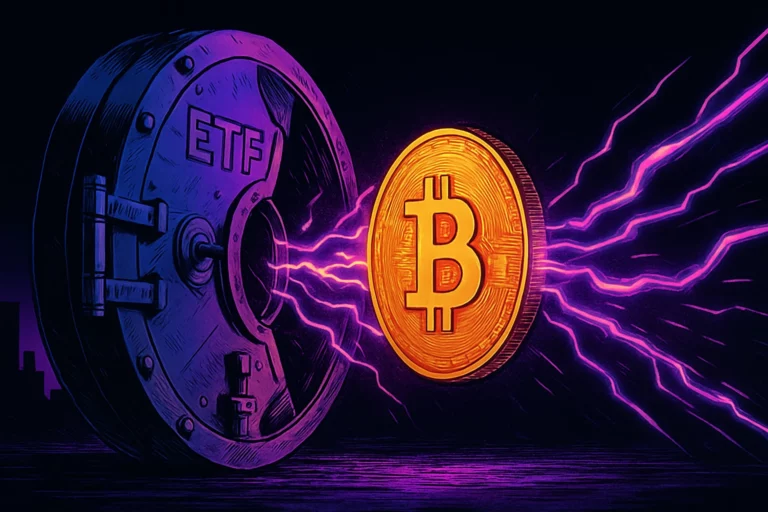

At current prices, the market value of MicroStrategy’s Bitcoin holdings is approximately $71.77 billion, with unrealized gains of approximately $28.16 billion. Currently, for many institutions, buying MSTR is almost equivalent to buying a “corporate Bitcoin ETF.”

MSTR stock price

According to the latest data from Google Finance, the U.S. micro-strategy stock MSTR was temporarily quoted at $426 after the market closed, an increase of 0.72%, with a market value of approximately $121.6 billion.

It is worth mentioning that so far this year, MicroStrategy’s stock price has risen from around US$289 to over US$450 before falling slightly, with an increase of nearly 50%, making it one of the brightest stocks in the US stock market.

High returns are accompanied by high volatility: investors need to self-assess risks

However, there are still multiple hidden worries behind the bright numbers. On the one hand, the price of Bitcoin fluctuates violently. Once the market reverses, MicroStrategy’s huge positions will put pressure on its financial reports; on the other hand, although equity financing has eased its debt, continued issuance may also dilute shareholder rights. Therefore, in the process of Strategy turning from a software supplier to a "Bitcoin asset manager", the rewards and risks are also magnified simultaneously.

In summary, Strategy has pushed its Bitcoin holdings to the threshold of 610,000 by adding more positions, becoming a heavyweight participant that cannot be ignored in the encryption market. For investors, MSTR provides a highly leveraged and highly volatile channel to share the dividends of Bitcoin growth, but this path is not easy: although the floating profits are dazzling, the risks are also real, so investors need to remain cautious at all times.