Buffett waited six years to finally buy Google! After spending $4.3 billion, Alphabet became Berkshire Hathaway’s tenth largest holding

In its latest 13F filing, Berkshire Hathaway spent $4.3 billion to buy Alphabet and once again reduced its holdings in Apple, highlighting that the value investment framework is being fine-tuned due to the AI wave.

(Preliminary summary: The full text of Buffett’s last shareholder letter: Live the life you want to be remembered and call it quits after 60 years at the helm of Berkshire Hathaway)

(Background supplement: Buffett confessed: I really feel that I am getting old, thinking and reading are getting difficult.. First talk about the decision to step down as CEO of Berkshire Hathaway)

Contents of this article

Pokesha Hathaway announced on the 14th The 13F filing disclosed that the company bought 17.85 million shares of Alphabet for the first time, with a market value of approximately US$4.3 billion, and lowered its position in Apple for the third consecutive quarter, selling an additional 41.8 million shares in a single quarter.

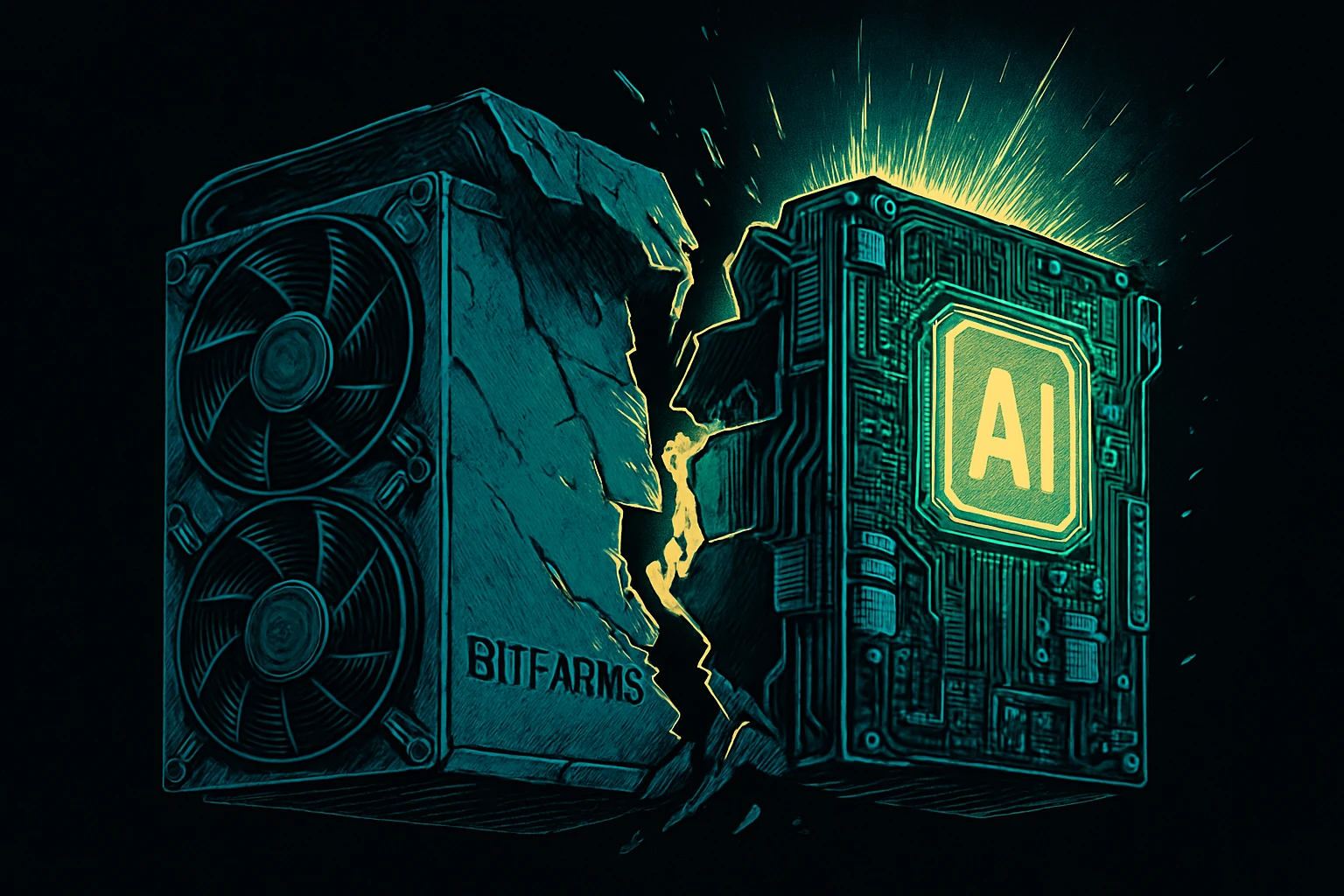

This action indicates that Buffett seems to have new ideas for technology stocks: when the cloud and AI-driven Alphabet are put on the table, Apple, which is slowing down the iPhone cycle and making slow progress in AI, continues to be sold. (Buffett has always been cautious about new startups and the technology industry because these companies have high price-to-earnings ratios and unpredictable operating prospects)

$4.3 billion bet: Alphabet becomes a core holding

13F Data shows that Alphabet has directly squeezed into Berkshire's top ten U.S. stock positions this time.

Alphabet’s stock price has risen 45.4% this year, driven by the recovery of its Cloud business and search advertising driven by demand for AI. Berkshire Hathaway's big move is seen by the market as confirmation of Alphabet's moat: more than 90% of the search engine market share, YouTube's video advertising cash flow, and the technical depth of self-developed TPU chips and Gemini large language models.

From regret to entry: price and value of six years of waiting

As early as 2019 At the annual shareholder meeting, Buffett once mentioned missing out on the Google investment opportunity. He described it as "an annoying thing," but it seems that he has not waited for the right time to enter the market for many years.

"Back then we were using Google services, but we didn't expect to buy stocks. This was one of the few decisions I really regretted."

We know that Berkshire's net sales and cash levels have hit record highs many times over the past year, but this time it was sold. It is generally believed that investment managers Todd Combs and Ted Weschler, who are more familiar with the technology industry, play key roles, reflecting the transformation of Berkshire's decision-making mechanism from a single legend to a dual-core era. (Buffett will confirm his withdrawal from daily operations of Berkshire Hathaway at the end of this year)

Portfolio thinking of reducing Apple holdings

On the other hand, Apple is firmly the largest holding of Berkshire Hathaway, but its peak weight once approached 40% of the portfolio.

However, the concentrated risks, coupled with the slowdown in iPhone growth and the long-term valuation above 30 times the price-to-earnings ratio, have led Berkshire Hathaway to choose to "continue to reduce its position". Apple relies on hardware update cycles, while Alphabet relies on cloud subscriptions and advertising algorithms to steadily expand cash flow. The difference in operating rhythm between the two has become the core basis for Berkshire Hathaway's position adjustment.

Observe the future: The next page of Berkshire’s value investment

This portfolio reshaping shows that value investment is not insulated from technology, but rather waiting for the moment when valuation and moat meet reasonably. When AI moves from concept to cash flow, Alphabet's enterprise infrastructure characteristics are recognized by traditional value groups.