Bloomberg: Tether plans to raise US$20 billion and consider "stock tokenization", halting shareholder selling to protect the US$500 billion valuation

According to the latest report from Bloomberg, Tether, the world’s largest stablecoin USDT issuer, is planning to raise up to US$20 billion through the issuance of new shares, corresponding to its previously reported valuation of US$500 billion.

(Preliminary briefing: Tether is valued at US$500 billion, overtaking SpaceX and ByteDance, and one article reveals the path to becoming the leader of stablecoins)

(Background supplement: Tether financial analysis in 2025: an additional US$4.5 billion in reserves is needed to maintain stability)

According to the latest report from Bloomberg, Tether, the world’s largest stablecoin USDT issuer, is planning to raise the highest amount of funds through the issuance of new shares. 20 billion US dollars, corresponding to its previously reported valuation of 500 billion US dollars.

At the same time, in order to ensure the smooth progress of this large-scale fundraising, Tether executives are actively evaluating a number of plans to improve investor liquidity, including stock buybacks and "tokenization" of the company's shares after the fundraising is completed, that is, converting traditional stocks into digital assets on the blockchain, allowing investors to more conveniently trade and transfer on the chain in the future, further attracting institutional funds to enter the market.

Tether stopped shareholders from selling their holdings at low prices

It is worth mentioning that Bloomberg quoted people familiar with the matter as saying that Tether has recently stopped at least one existing shareholder from selling its holdings. It is reported that the shareholder originally planned to sell at least US$1 billion in shares, but his offer corresponded to a valuation of only US$280 billion, far lower than the US$500 billion target set by Tether.

In this regard, Tether management is worried that such low-price selling will disrupt its overall fundraising plan and lower its stock price, so it has made it clear that existing shareholders will not be allowed to sell their shares in this main fundraising round. At the same time, Tether also responded that it had received "clear confirmation from relevant shareholders that these actions will not continue" and warned that any attempt to bypass formal procedures and contact with unauthorized parties is "not prudent, and can even be said to be reckless."

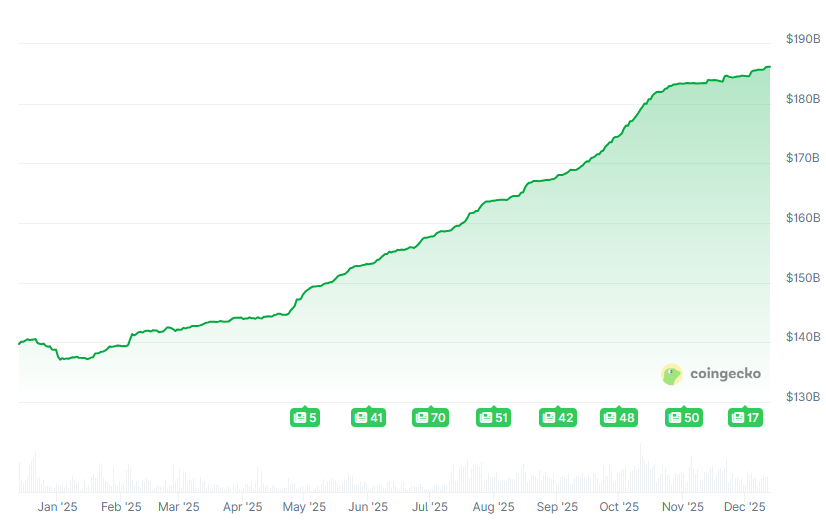

USDT’s market value is approaching US$190 billion

If calculated at a valuation of US$500 billion, Tether will stand shoulder to shoulder with the super giants OpenAI and SpaceX, becoming one of the most valuable companies in the world. Since the beginning of this year, the market value of USDT has continued to soar, approaching US$190 billion at the time of writing. Its strong cash flow has also become the biggest support for this high-valuation fundraising.