JPMorgan Chase calls Bitcoin to see $170,000 next year, and will keep a close eye on the micro-strategy mNAV 1 red line in the short term

JPMorgan Chase said that Bitcoin is expected to reach $170,000 within a year, but said that if Strategy fails due to mNAV or is delisted from MSCI, it may affect the short-term gains.

(Preliminary summary: BlackRock CEO publicly admitted his mistake: Bitcoin is not only a crime, it is a fear asset with high volatility)

(Background supplement: Cryptocurrency ETF funds are withdrawing at the speed of light, can issuers such as BlackRock still make money?)

After Bitcoin (Bitcoin) broke through a maximum of $94,000 yesterday, it is currently fluctuating around $92,000. The bulls and shorts have not yet seen who is clearly at the top. However, JPMorgan Chase released a report earlier, raising the target price of Bitcoin to $170,000 in the next 6 to 12 months, which is an estimated increase of more than 80% at current prices.

The bank’s analysts believe that macro hedging demand will eventually drive prices to highs, but also remind that short-term momentum depends on the liquidity of individual large currency holders.

Strategy’s financial pressure has become a variable

At the same time, JPMorgan Chase’s report named micro-strategy (Strategy) The financial situation is the key to the short-term market price of Bitcoin. Analysts calculate that Strategy's mNAV is currently around 1.1, one step away from the 1.0 warning line. If it falls below, it means that the company's market value is lower than the value of the Bitcoins it holds, which may trigger creditors or investors to demand recovery of cash and be forced to sell their positions, and the market may experience chain selling pressure.

In order to maintain its HODL position, Strategy has previously sold shares to raise approximately US$1.44 billion in cash. Officials said that this fund is sufficient to pay interest and dividends in the next two years. The company has also extended debt maturities through perpetual preferred stocks and convertible bonds.

However, its profit forecast for 2025 has been significantly revised down from US$24 billion to a loss of US$5.5 billion to a profit of US$6.3 billion, and there is a risk of being removed from the MSCI index, further depressing the stock price and worsening mNAV. (MSCI will decide in January whether to exclude companies with 50% or more of their assets invested in digital assets from its indexes.)

Further reading: Michael Saylor responded that "micro-strategies may be removed from the MSCI index": Our Bitcoin business is unique, and the index classification cannot be defined

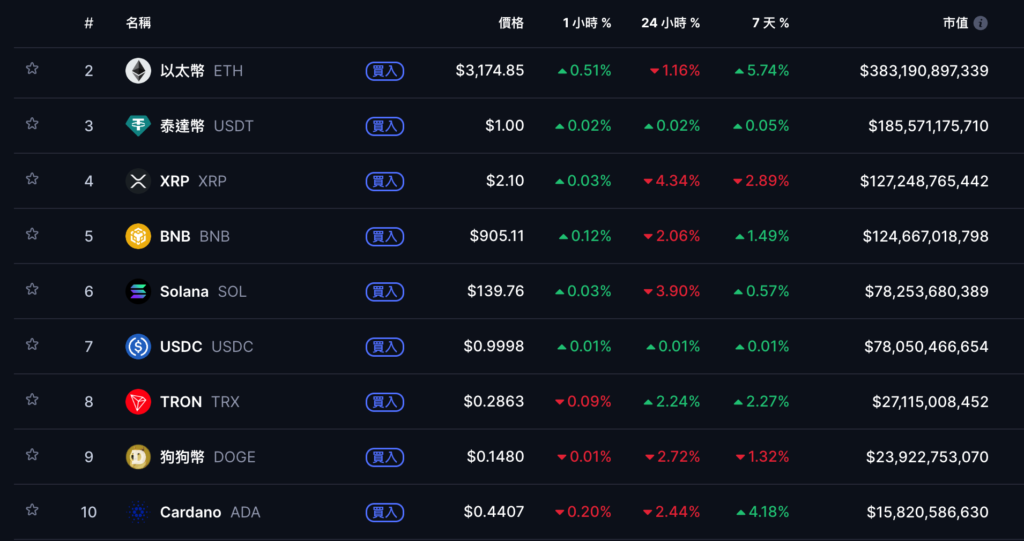

The top ten tokens fluctuated simultaneously

Other top ten tokens mainly followed the trend of Bitcoin. Ethereum fell back from US$3,200, and the largest decliner in the past 24 hours was XRP, now trading at US$2.1.