Google Play removed 17 Korean "unregistered overseas exchanges" KuCoin, MEXC, CoinW...all blocked

The South Korean Financial Services Commission (FSC) recently issued an announcement stating that starting from March 25, 2025, in response to the request of the South Korean government, Google has implemented domestic access restrictions on 17 foreign cryptocurrency trading platforms on its app store Google Play. These exchanges include KuCoin, MEXC, etc.

(Previous summary: South Korea has listed five unregistered VASP "overseas exchanges" including BitMEX and KuCoin as targets of sanctions. Will Taiwan follow suit?)

/>(Background supplement: South Korea’s Bithumb exchange was exposed in a series of scandals.) It involved spending 3 billion won to buy a house for the former CEO and was raided. The intermediary fee for currency listing started at US$2 million...)

Contents of this article

The South Korean Financial Services Commission (FSC) recently issued an announcement stating that starting from March 25, 2025, in response to the requirements of the Korean government, Google has banned 17 of its app stores on Google Play. Foreign cryptocurrency exchanges have implemented onshore access restrictions, including KuCoin, MEXC, Phemex, XT.com, Bitrue, CoinW, CoinEX, ZoomEX, Poloniex, BTCC, DigiFinex, Pionex, Blofin, Apex Pro, CoinCatch, WEEX and BitMart.

In other words, new users in South Korea can no longer search for, download or install these exchanges through Google Play; at the same time, existing users who have installed these apps will also be unable to update, resulting in a significant limitation of the accessibility and continuity of services of these platforms in the Korean market. (Of course, there may be a solution through VPN, but it still increases the difficulty of user operation)

FSC: These exchanges are not registered in South Korea

Regarding this regulatory action, the South Korean Financial Services Commission (FSC) pointed out that these platforms actively marketed and provided services to local traders in South Korea without completing the registration process in accordance with South Korean laws, constituting a blatant violation of South Korean regulatory regulations.

In addition, the FSC also emphasized that the main purpose of this action against 17 exchanges is to prevent financial crimes such as money laundering and terrorist financing, and to protect domestic investors from potential fraud and market manipulation risks.

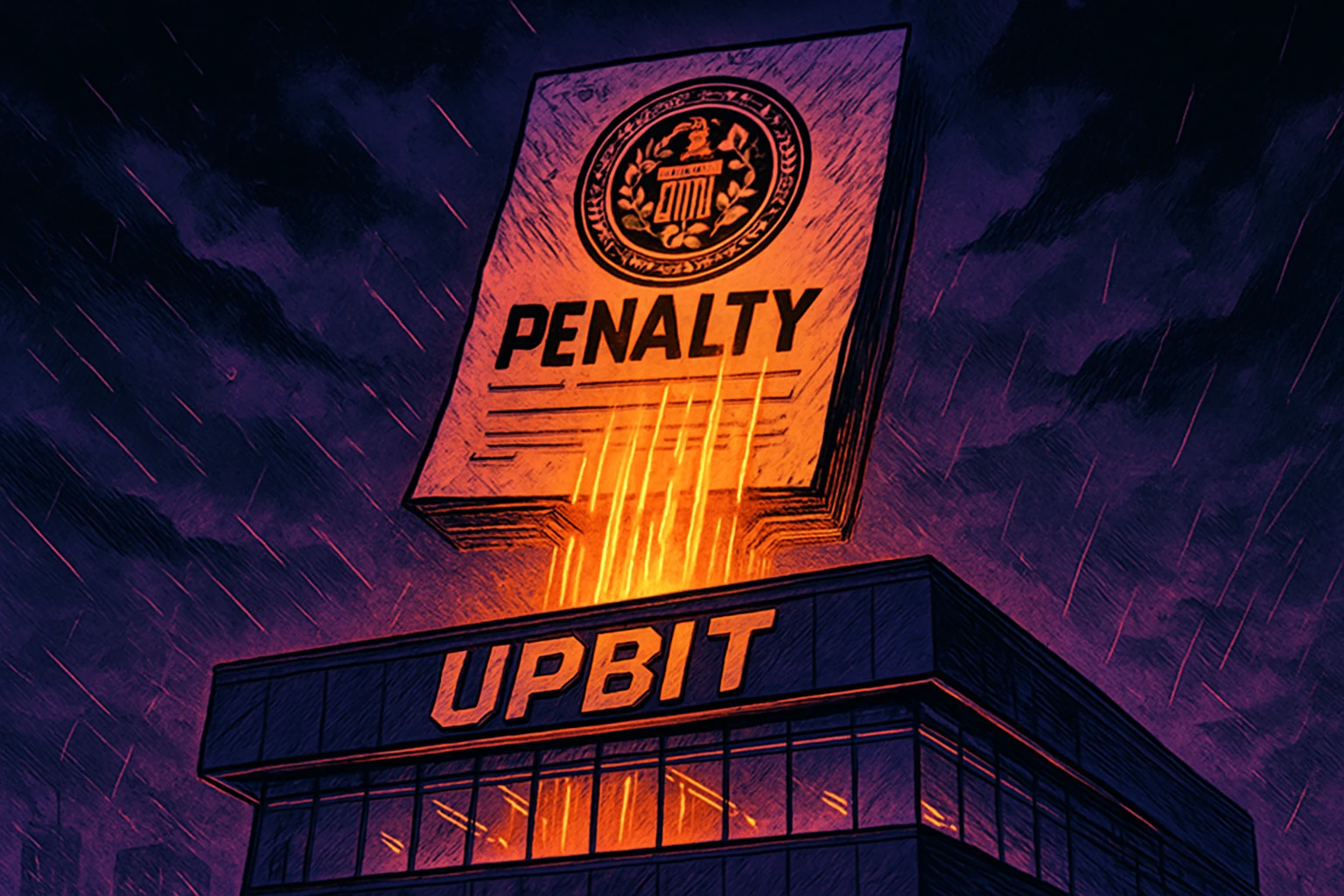

This is not the first time to crack down on exchanges

South Korea has one of the strictest cryptocurrency regulatory frameworks in the world. Its core bill is the Act on Reporting and Using Specified Financial Transaction. Information), the bill requires all virtual asset service providers (VASPs) operating in South Korea or providing services to Korean residents, regardless of where they are headquartered, to register with the Korean Financial Intelligence Unit (FIU).

In fact, this is not the first time that the Korean authorities have taken a tough stance against unregistered foreign exchanges. As early as 2022, the FIU had identified and notified 16 unregistered platforms and imposed restrictive measures including website blocking. Then in 2023, six more platforms were added to the restricted list.

Is encryption regulation tightening in South Korea?

Regarding this latest law enforcement action in South Korea, pessimists believe that South Korea’s cryptocurrency supervision is already strict, and this attack on up to 17 exchanges will not only limit the trading options of local users, but may even stifle innovation.

However, some people hold a positive view, because as early as January this year, the Korean regulatory authorities announced the main work plan for 2025, which is expected to gradually open up legal persons to participate in virtual asset transactions, and promote the second phase of regulatory bills, focusing on stablecoin management, listing standards and exchange regulations, to further improve the market regulatory framework; in addition, earlier this month, FSC It was also stated at a meeting with local cryptocurrency industry experts that South Korea plans to issue comprehensive guidelines for listed companies and professional investors before the third quarter of this year; and is expected to launch guidelines for non-profit organizations and cryptocurrency exchanges earlier this year. The current plan is initially scheduled for April.

Therefore, a series of recent actions by the Korean regulatory authorities indicate that the Korean government is working hard to create a more standardized, transparent and structured market environment - this clear regulatory framework is exactly the certainty that many traditional financial (TradFi) institutions are looking for before entering the field of digital assets.

A strictly regulated market, although it may lack some of the "freedom" of the early Wild West, can give large institutional investors the confidence they need and reduce their compliance risk concerns. It may be beneficial to the development of local cryptocurrency in South Korea in the long run. More time is needed to observe.